Quantile regression#

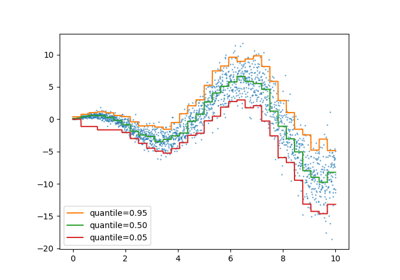

This example illustrates how quantile regression can predict non-trivial conditional quantiles.

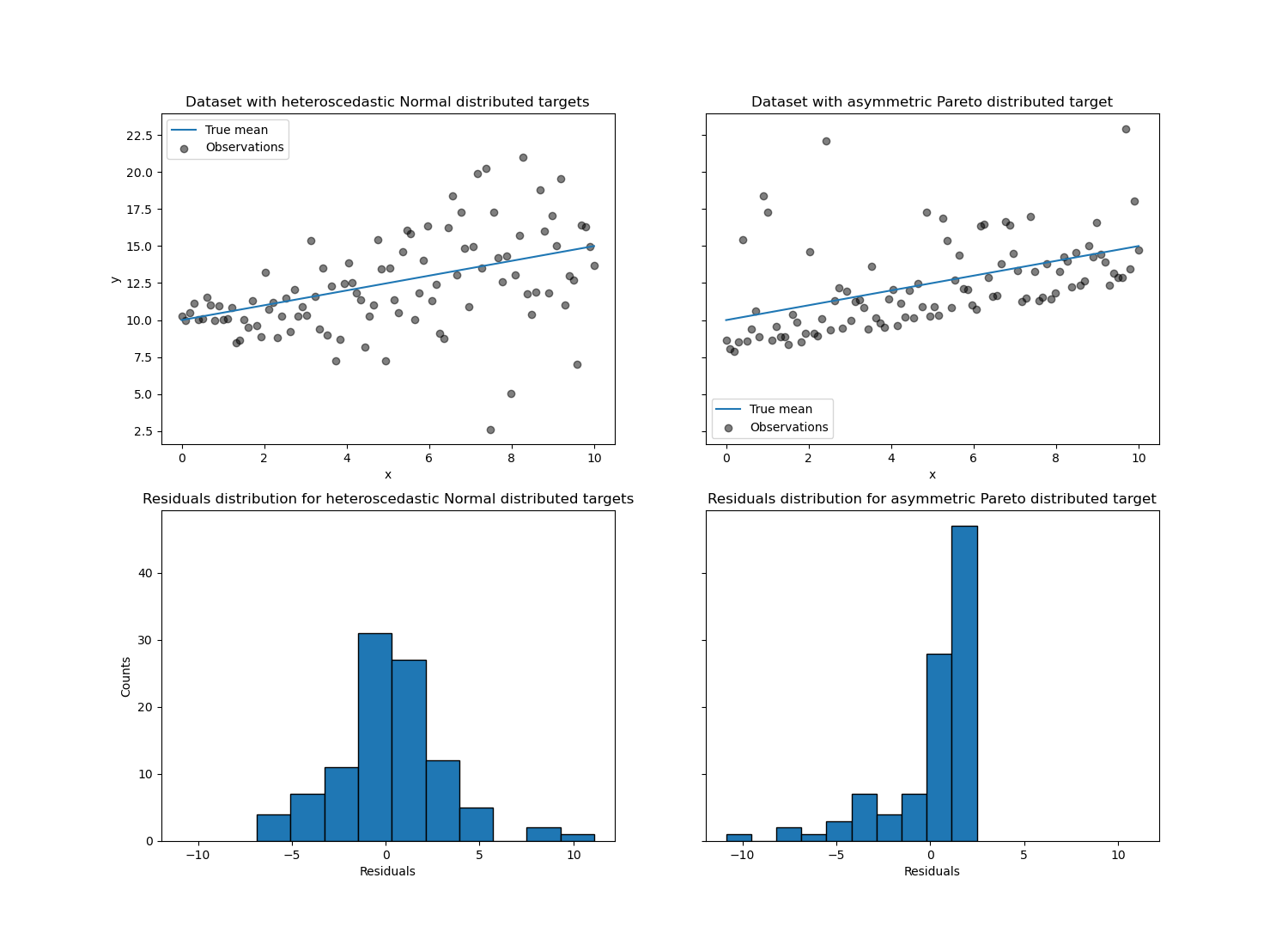

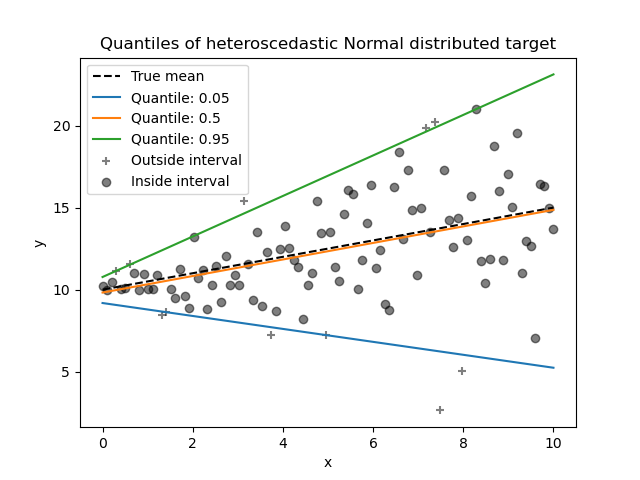

The left figure shows the case when the error distribution is normal, but has non-constant variance, i.e. with heteroscedasticity.

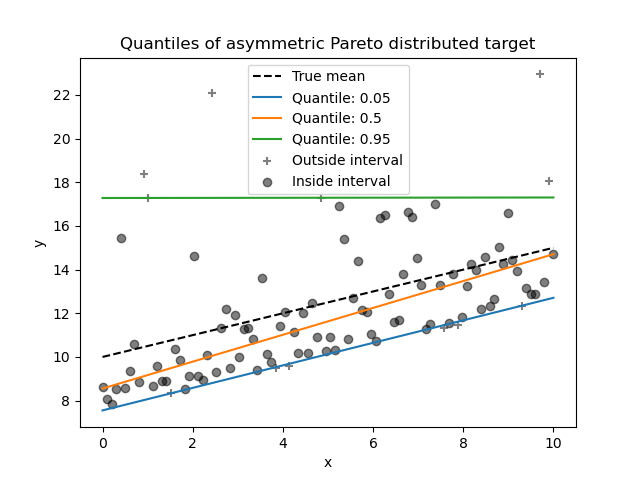

The right figure shows an example of an asymmetric error distribution, namely the Pareto distribution.

# Authors: David Dale <dale.david@mail.ru>

# Christian Lorentzen <lorentzen.ch@gmail.com>

# Guillaume Lemaitre <glemaitre58@gmail.com>

# License: BSD 3 clause

Dataset generation#

To illustrate the behaviour of quantile regression, we will generate two

synthetic datasets. The true generative random processes for both datasets

will be composed by the same expected value with a linear relationship with a

single feature x.

import numpy as np

rng = np.random.RandomState(42)

x = np.linspace(start=0, stop=10, num=100)

X = x[:, np.newaxis]

y_true_mean = 10 + 0.5 * x

We will create two subsequent problems by changing the distribution of the

target y while keeping the same expected value:

in the first case, a heteroscedastic Normal noise is added;

in the second case, an asymmetric Pareto noise is added.

y_normal = y_true_mean + rng.normal(loc=0, scale=0.5 + 0.5 * x, size=x.shape[0])

a = 5

y_pareto = y_true_mean + 10 * (rng.pareto(a, size=x.shape[0]) - 1 / (a - 1))

Let’s first visualize the datasets as well as the distribution of the

residuals y - mean(y).

import matplotlib.pyplot as plt

_, axs = plt.subplots(nrows=2, ncols=2, figsize=(15, 11), sharex="row", sharey="row")

axs[0, 0].plot(x, y_true_mean, label="True mean")

axs[0, 0].scatter(x, y_normal, color="black", alpha=0.5, label="Observations")

axs[1, 0].hist(y_true_mean - y_normal, edgecolor="black")

axs[0, 1].plot(x, y_true_mean, label="True mean")

axs[0, 1].scatter(x, y_pareto, color="black", alpha=0.5, label="Observations")

axs[1, 1].hist(y_true_mean - y_pareto, edgecolor="black")

axs[0, 0].set_title("Dataset with heteroscedastic Normal distributed targets")

axs[0, 1].set_title("Dataset with asymmetric Pareto distributed target")

axs[1, 0].set_title(

"Residuals distribution for heteroscedastic Normal distributed targets"

)

axs[1, 1].set_title("Residuals distribution for asymmetric Pareto distributed target")

axs[0, 0].legend()

axs[0, 1].legend()

axs[0, 0].set_ylabel("y")

axs[1, 0].set_ylabel("Counts")

axs[0, 1].set_xlabel("x")

axs[0, 0].set_xlabel("x")

axs[1, 0].set_xlabel("Residuals")

_ = axs[1, 1].set_xlabel("Residuals")

With the heteroscedastic Normal distributed target, we observe that the

variance of the noise is increasing when the value of the feature x is

increasing.

With the asymmetric Pareto distributed target, we observe that the positive residuals are bounded.

These types of noisy targets make the estimation via

LinearRegression less efficient, i.e. we need

more data to get stable results and, in addition, large outliers can have a

huge impact on the fitted coefficients. (Stated otherwise: in a setting with

constant variance, ordinary least squares estimators converge much faster to

the true coefficients with increasing sample size.)

In this asymmetric setting, the median or different quantiles give additional insights. On top of that, median estimation is much more robust to outliers and heavy tailed distributions. But note that extreme quantiles are estimated by very few data points. 95% quantile are more or less estimated by the 5% largest values and thus also a bit sensitive outliers.

In the remainder of this tutorial, we will show how

QuantileRegressor can be used in practice and

give the intuition into the properties of the fitted models. Finally,

we will compare the both QuantileRegressor

and LinearRegression.

Fitting a QuantileRegressor#

In this section, we want to estimate the conditional median as well as a low and high quantile fixed at 5% and 95%, respectively. Thus, we will get three linear models, one for each quantile.

We will use the quantiles at 5% and 95% to find the outliers in the training sample beyond the central 90% interval.

from sklearn.utils.fixes import parse_version, sp_version

# This is line is to avoid incompatibility if older SciPy version.

# You should use `solver="highs"` with recent version of SciPy.

solver = "highs" if sp_version >= parse_version("1.6.0") else "interior-point"

from sklearn.linear_model import QuantileRegressor

quantiles = [0.05, 0.5, 0.95]

predictions = {}

out_bounds_predictions = np.zeros_like(y_true_mean, dtype=np.bool_)

for quantile in quantiles:

qr = QuantileRegressor(quantile=quantile, alpha=0, solver=solver)

y_pred = qr.fit(X, y_normal).predict(X)

predictions[quantile] = y_pred

if quantile == min(quantiles):

out_bounds_predictions = np.logical_or(

out_bounds_predictions, y_pred >= y_normal

)

elif quantile == max(quantiles):

out_bounds_predictions = np.logical_or(

out_bounds_predictions, y_pred <= y_normal

)

Now, we can plot the three linear models and the distinguished samples that are within the central 90% interval from samples that are outside this interval.

plt.plot(X, y_true_mean, color="black", linestyle="dashed", label="True mean")

for quantile, y_pred in predictions.items():

plt.plot(X, y_pred, label=f"Quantile: {quantile}")

plt.scatter(

x[out_bounds_predictions],

y_normal[out_bounds_predictions],

color="black",

marker="+",

alpha=0.5,

label="Outside interval",

)

plt.scatter(

x[~out_bounds_predictions],

y_normal[~out_bounds_predictions],

color="black",

alpha=0.5,

label="Inside interval",

)

plt.legend()

plt.xlabel("x")

plt.ylabel("y")

_ = plt.title("Quantiles of heteroscedastic Normal distributed target")

Since the noise is still Normally distributed, in particular is symmetric,

the true conditional mean and the true conditional median coincide. Indeed,

we see that the estimated median almost hits the true mean. We observe the

effect of having an increasing noise variance on the 5% and 95% quantiles:

the slopes of those quantiles are very different and the interval between

them becomes wider with increasing x.

To get an additional intuition regarding the meaning of the 5% and 95% quantiles estimators, one can count the number of samples above and below the predicted quantiles (represented by a cross on the above plot), considering that we have a total of 100 samples.

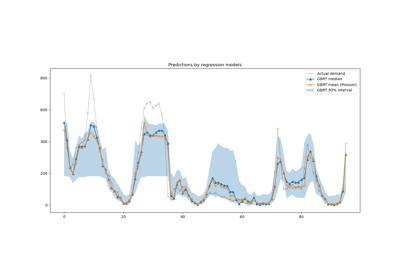

We can repeat the same experiment using the asymmetric Pareto distributed target.

quantiles = [0.05, 0.5, 0.95]

predictions = {}

out_bounds_predictions = np.zeros_like(y_true_mean, dtype=np.bool_)

for quantile in quantiles:

qr = QuantileRegressor(quantile=quantile, alpha=0, solver=solver)

y_pred = qr.fit(X, y_pareto).predict(X)

predictions[quantile] = y_pred

if quantile == min(quantiles):

out_bounds_predictions = np.logical_or(

out_bounds_predictions, y_pred >= y_pareto

)

elif quantile == max(quantiles):

out_bounds_predictions = np.logical_or(

out_bounds_predictions, y_pred <= y_pareto

)

plt.plot(X, y_true_mean, color="black", linestyle="dashed", label="True mean")

for quantile, y_pred in predictions.items():

plt.plot(X, y_pred, label=f"Quantile: {quantile}")

plt.scatter(

x[out_bounds_predictions],

y_pareto[out_bounds_predictions],

color="black",

marker="+",

alpha=0.5,

label="Outside interval",

)

plt.scatter(

x[~out_bounds_predictions],

y_pareto[~out_bounds_predictions],

color="black",

alpha=0.5,

label="Inside interval",

)

plt.legend()

plt.xlabel("x")

plt.ylabel("y")

_ = plt.title("Quantiles of asymmetric Pareto distributed target")

Due to the asymmetry of the distribution of the noise, we observe that the true mean and estimated conditional median are different. We also observe that each quantile model has different parameters to better fit the desired quantile. Note that ideally, all quantiles would be parallel in this case, which would become more visible with more data points or less extreme quantiles, e.g. 10% and 90%.

Comparing QuantileRegressor and LinearRegression#

In this section, we will linger on the difference regarding the error that

QuantileRegressor and

LinearRegression are minimizing.

Indeed, LinearRegression is a least squares

approach minimizing the mean squared error (MSE) between the training and

predicted targets. In contrast,

QuantileRegressor with quantile=0.5

minimizes the mean absolute error (MAE) instead.

Let’s first compute the training errors of such models in terms of mean squared error and mean absolute error. We will use the asymmetric Pareto distributed target to make it more interesting as mean and median are not equal.

from sklearn.linear_model import LinearRegression

from sklearn.metrics import mean_absolute_error, mean_squared_error

linear_regression = LinearRegression()

quantile_regression = QuantileRegressor(quantile=0.5, alpha=0, solver=solver)

y_pred_lr = linear_regression.fit(X, y_pareto).predict(X)

y_pred_qr = quantile_regression.fit(X, y_pareto).predict(X)

print(

f"""Training error (in-sample performance)

{linear_regression.__class__.__name__}:

MAE = {mean_absolute_error(y_pareto, y_pred_lr):.3f}

MSE = {mean_squared_error(y_pareto, y_pred_lr):.3f}

{quantile_regression.__class__.__name__}:

MAE = {mean_absolute_error(y_pareto, y_pred_qr):.3f}

MSE = {mean_squared_error(y_pareto, y_pred_qr):.3f}

"""

)

Training error (in-sample performance)

LinearRegression:

MAE = 1.805

MSE = 6.486

QuantileRegressor:

MAE = 1.670

MSE = 7.025

On the training set, we see that MAE is lower for

QuantileRegressor than

LinearRegression. In contrast to that, MSE is

lower for LinearRegression than

QuantileRegressor. These results confirms that

MAE is the loss minimized by QuantileRegressor

while MSE is the loss minimized

LinearRegression.

We can make a similar evaluation by looking at the test error obtained by cross-validation.

from sklearn.model_selection import cross_validate

cv_results_lr = cross_validate(

linear_regression,

X,

y_pareto,

cv=3,

scoring=["neg_mean_absolute_error", "neg_mean_squared_error"],

)

cv_results_qr = cross_validate(

quantile_regression,

X,

y_pareto,

cv=3,

scoring=["neg_mean_absolute_error", "neg_mean_squared_error"],

)

print(

f"""Test error (cross-validated performance)

{linear_regression.__class__.__name__}:

MAE = {-cv_results_lr["test_neg_mean_absolute_error"].mean():.3f}

MSE = {-cv_results_lr["test_neg_mean_squared_error"].mean():.3f}

{quantile_regression.__class__.__name__}:

MAE = {-cv_results_qr["test_neg_mean_absolute_error"].mean():.3f}

MSE = {-cv_results_qr["test_neg_mean_squared_error"].mean():.3f}

"""

)

Test error (cross-validated performance)

LinearRegression:

MAE = 1.732

MSE = 6.690

QuantileRegressor:

MAE = 1.679

MSE = 7.129

We reach similar conclusions on the out-of-sample evaluation.

Total running time of the script: (0 minutes 0.578 seconds)

Related examples

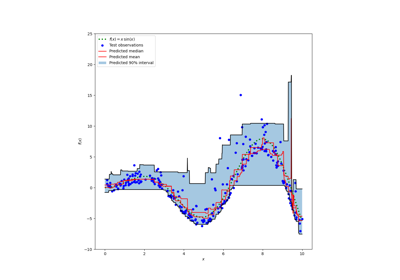

Prediction Intervals for Gradient Boosting Regression